Excellence through Preparation

Your comprehensive source of practice exams and study guides

for the most recognized financial planning designations in Canada

About PlannerPrep

Support your preparation and studying with PlannerPrep’s comprehensive packages of practice exams and study guides

Save precious time by preparing faster and improve your chances of passing the exam on your first attempt thanks to our simulated practice exams and premium study guide content.

Our focused content, competitive pricing and simple to use platform allows you to study when and where you want. Our dedicated team of financial planners have prepared our Practice Exams and Study Guides that focus on the mastery of concepts by rigorously applying what you’ve learned and strategically tackling large volumes of exam content.

Main Features

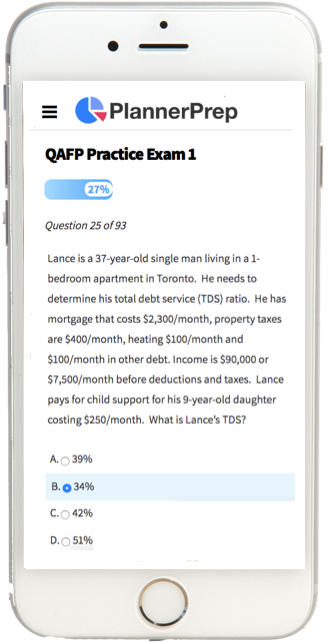

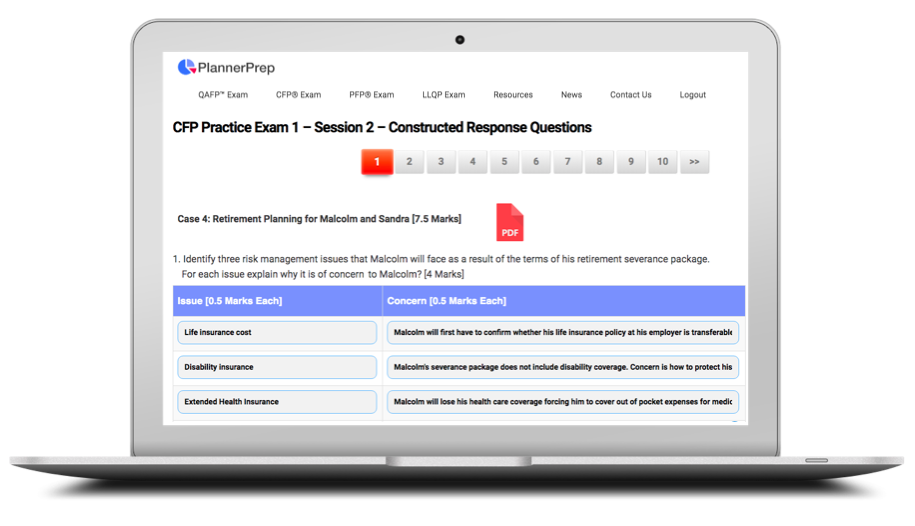

Practice Exams Structured to Simulate the Actual FP Canada Exams

- Our CFP and QAFP practice exams have the same number of multiple choice and case study questions as the official exams.

- PlannerPrep’s software makes the experience of taking the practice exams as relevant as possible

- All practice exams include detailed answer key with explanations and traceability to competency profiles

- Multiple attempts available for each practice exam

Focused Study Guides Reduce Your Study Time

- Our comprehensive Study Guides cover all competency areas and financial planning areas

- Downloadable PDF included for smartphones, computers and print-outs

- Focused content ensure study time is as efficient as possible

Multiple Choice Question Banks

- CFP and PFP Question Banks contain 500 multiple choice questions each

- LLQP Question Bank contains 1,000 multiple choice questions

- Correct answers and rationale available after each questions

- Results based on financial planning area

- Customize question formats to create question bank subsets to focus on specific financial planning areas

Affordable Product Bundles

- Choose the product bundle most suitable to your needs and save

- Leverage the power of our full set of products and content to succeed

Comprehensive Content

- 3 QAFP Practice Exams include 60 multiple choice questions based on 6 full case studies

- 3 CFP Practice Exams include 30+ constructed response questions

- Over 2,000 multiple choice questions across all our products

- Study Guides cover all financial planning areas in 300+ pages

PlannerPrep’s Testimonials

I wanted to reach out and let you know that your material helped during my writing of the October CFP Exam, I passed and found the exam to be easier than I thought it’d be. Having now used your QAFP and CFP materials, I wanted to say thank you. I found it very helpful in both cases, and unbelievably priced compared to what else is out there.

I just wrote my AFP1 and passed the exam. Your practice questions were extremely helpful.

I found your study material very helpful in studying for the CFP exam. I ended up passing the November 2021 exam.

PlannerPrep is a great resource for preparing for the CFP Exam. With 500 questions to select from, I definitely got my reps in. I like how you can select questions from any financial planning area to focus on.

This was great resource for the QAFP exam. Their case studies were in depth and challenging. Worth the investment in time and money.

I’m happy I stumbled across PlannerPrep. Their financial planner exam questions were challenging. The calculation questions have always been a challenge for me but they provide detail answers and where I went wrong. Thanks again!

Latest News

Why Relying Solely on ‘Break-Even Age’ for Determining CPP Start Dates can Lead Client’s Astray Deciding when to start taking Canada Pension Plan (CPP) benefits is a significant choice for many Canadians, with the “break-even age” often used as a key factor in this decision. This term refers to the age at which the total […]

Options for When Term Life Insurance Ends Financial planners frequently observe families hastily purchasing term life insurance when their children are very young, only to later question their next steps as the term concludes. Term 10 or Term 20 life insurance policies offer a cost-effective solution for individuals seeking coverage without the burden of high […]

Tips for Efficiently Managing RRIF Withdrawals and Avoiding Hefty Penalties Registered Retirement Savings Plans (RRSPs) eventually have to be taxed as income once withdrawn. Often, after conversion into a Registered Retirement Income Fund (RRIF), a specific percentage must be withdrawn each year. Financial planners have various strategies to reduce taxes on RRIF withdrawals, especially when […]